Last Updated: January 15, 2024

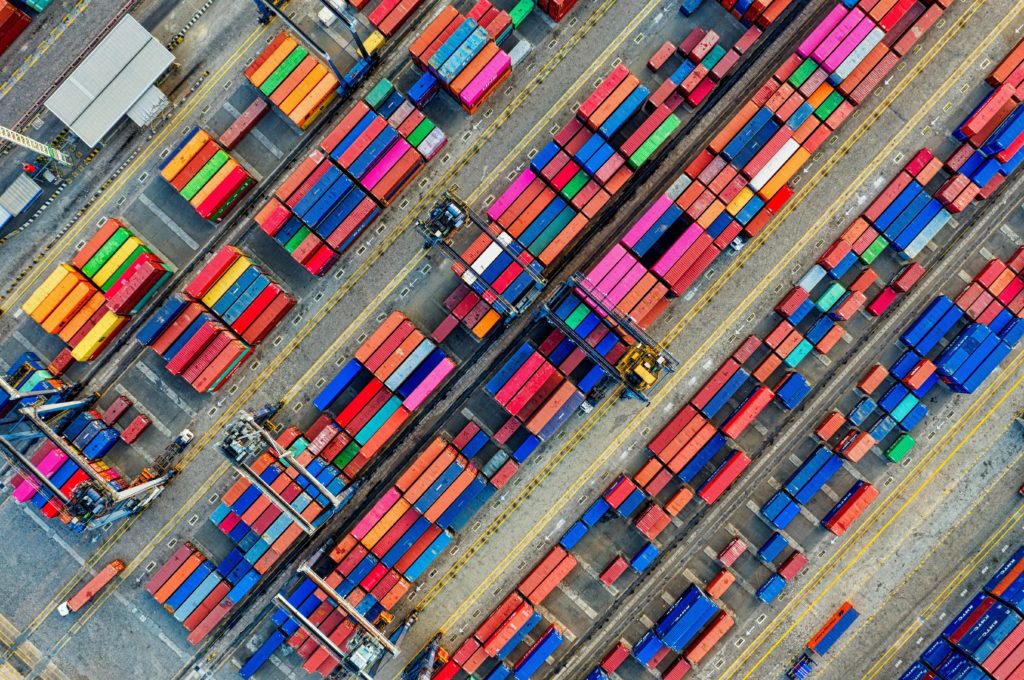

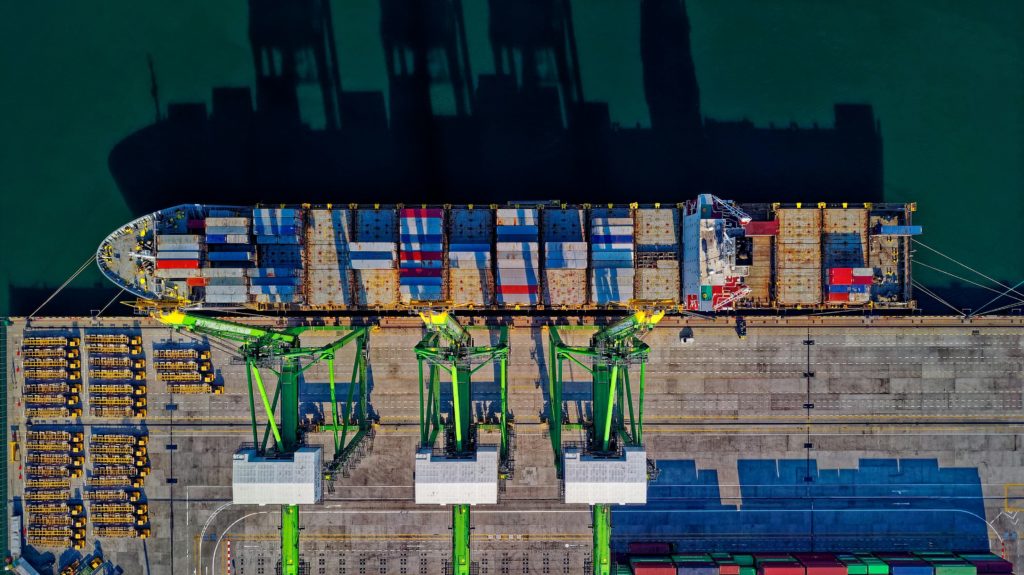

Carbon import fees are gaining momentum worldwide. These policies charge imports based on their carbon footprint, holding producers accountable for the emissions tied to their goods. Here’s a brief overview of actions toward implanting these types of policies. For more detail on each proposal, please download our reference guide, which is routinely updated to reflect new information.

Active and Proposed Policies

Active: European Union’s Carbon Border Adjustment Mechanism (CBAM)

Enacted on Oct 1, 2023, the EU’s Carbon Boarder Adjustment Mechanism requires that importers of covered products report emissions information related to the manufacturing of their goods. Beginning in 2026, importers may be subject to fees for too high of carbon emissions on covered products.

Proposed: United Kingdom’s CBAM

The United Kingdom will be the second jurisdiction to adopt a CBAM, likely modeled after the EU’s version. Details will be finalized through further consultation.

Proposed: Global Arrangement on Sustainable Steel and Aluminum (GASSA)

The U.S. and the EU are in ongoing negotiations to establish a trade relationship that helps to address the carbon intensity and global over-capacity of steel and aluminum production.

Proposed: Foreign Pollution Fee Act of 2023

The “Foreign Pollution Fee Act of 2023” directs the U.S. Treasury Department to create an advisory board consisting of executive branch agencies and informed stakeholders to focus on leveling the international playing field and expanding carbon-efficient American manufacturing.

Proposed: Clean Competition Act of 2023

The “Clean Competition Act of 2023” would impose a “carbon intensity charge” on imports of certain products that would mirror a domestic carbon price.

Proposed: MARKET CHOICE Act of 2023

The “Modernizing America with Rebuilding to Kickstart the Economy of the Twenty-first Century with a Historic Infrastructure-centered Expansion (MARKET CHOICE) Act” imposes a fee on specific domestic facilities as opposed to specific products.

Proposed: Energy Innovation and Carbon Dividend Act of 2023

The “Energy Innovation and Carbon Dividend Act of 2023” is a proposed carbon import fee that would operate alongside a domestic carbon fee on fuels and energy-intensive products.

Proposed: America’s Clean Future Fund Act of 2024

The “America’s Clean Future Act of 2024” would introduce an economy-wide domestic carbon price and would institute a boarder-adjusted carbon fee on fuels and certain energy-intensive goods.

Honorable Mention: PROVE IT Act of 2024

The “Providing Reliable, Objective, Verifiable Emissions Intensity and Transparency Act” is not a carbon import fee policy, per se. It would direct the Department of Energy (DOE) to study the emissions intensity of manufacturing for various products in the U.S. and in major international markets.

Policy Proposals for Carbon Intensity Import Fees

| Policy | Covered Products | Domestic Treatment | Carbon Charge | Covered Emissions | Revenue Usage |

| European Union CBAM | 4 energy-intensive products & 1 fuel, and electricity | Yes | Based on EU ETS allowance price ($73/ton CO2e as of Q2 2024) | CO2, PFCs, N2O | 25% to member states, 75% to the EU budget |

| United Kingdom CBAM | 4 energy-intensive product categories & 1 energy product | Yes | Based on UK ETS allowance price ($47/ton CO2e as of Q2 2024) | CO2, other gases TBD | TBD |

| Global Arrangement on Sustainable Steel and Aluminum | Iron & steel, aluminum | N/A | TBD | CO2, other gases TBD | TBD |

| Foreign Pollution Fee Act of 2023 | Fuels, energy-intensive products & clean energy goods | No | Ad valorem “variable tariffs” based on emissions intensity relative to U.S.-made products | CO2, CH4, N2O, HFCs, PFCs, SF6 | TBD |

| Clean Competition Act of 2023 | Fuels and energy-intensive products | Yes | $55/ton CO2e (2025), rising annually by 5% plus inflation | CO2, CH4, N2O, HFCs, PFCs, SF6 | 75% to domestic industrial decarbonization; 25% to assist climate and clean energy programs abroad. |

| MARKET CHOICE Act of 2023 | Fuels, industrial products & clean energy goods | Yes | $35/ton CO2e (2025), rising annually by 5% plus inflation | CO2, CH4, N2O, HFCs, PFCs, SF6 | 75% to infrastructure, low-income households, and climate adaptation; 25% to Treasury |

| Energy Innovation and Carbon Dividend Act of 2023 | Fuels and energy-intensive products | Yes | $15/ton CO2e (2023), rising annually by $10/ton plus inflation | CO2, CH4, N2O | Unused revenue goes to UN’s Green Climate Fund (domestic pricing revenue handled separately) |

| America’s Clean Future Fund Act of 2024 | Fuels and energy-intensive products | Yes | $65/ton CO2e (2026), rising annually by $10/ton plus inflation | CO2, CH4, N2O, HFCs, PFCs, SF6 | 75% to low- and middle- income individuals through rebates, 25% to climate change adaptation and mitigation projects |

| Honorable Mention: PROVE IT Act of 2024 | Fuels, industrial products & clean energy goods | Studies U.S. and foreign products | Purely a study, no fee | CO2, CH4, N2O, HFCs, PFCs, SF6 | N/A |