Supply chain security has emerged as a defining priority among federal policymakers, with a particular focus on critical minerals. President Trump issued a day-one executive order (EO), “Unleashing American Energy,” to expand the U.S. upstream and midstream domestic footprint for critical minerals. Members of Congress have introduced three bills related to minerals this year, building from earnest, bipartisan work last Congress.

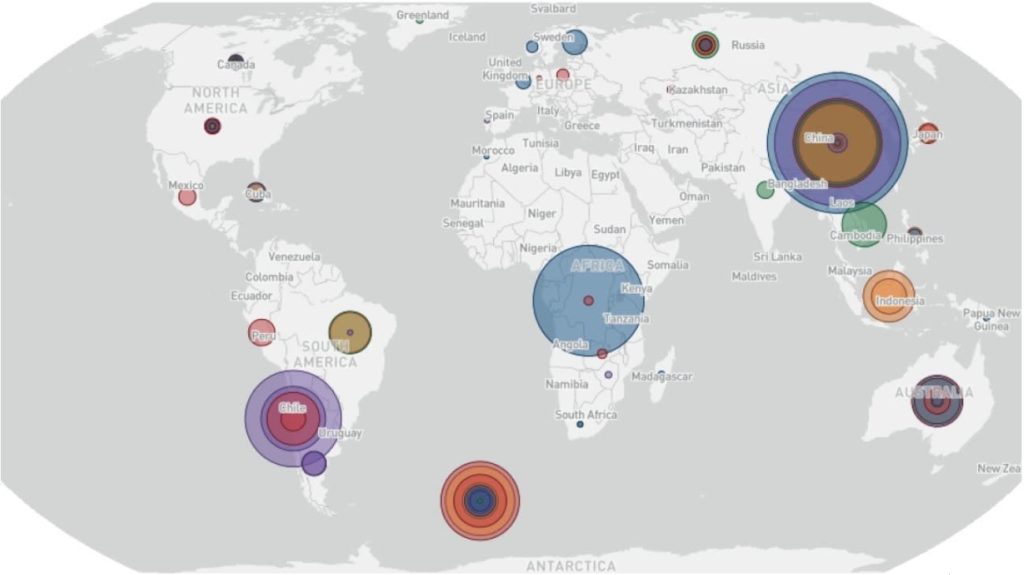

Secure and reliable access to critical minerals is increasingly urgent. The U.S. is heavily import-dependent and has extremely limited processing capacity. Of the 50 minerals deemed critical, the U.S. is entirely import-reliant for 12 and more than 50% import-reliant for another 29. China, on the other hand, controls approximately 60% of worldwide critical mineral production and 85% of processing capacity. Factored together, America’s import reliance and China’s market dominance invite market manipulation, complicating the ability of market-oriented firms to compete and rebalance market share away from one actor.

Market Manipulation

One form of market manipulation is supply disruption for geopolitical leverage. Last year, China tightened export controls on dual-use minerals, such as graphite, and banned exports to the U.S. for antimony, germanium, and gallium. In early February, China further tightened export controls on five strategic minerals in response to the Trump administration’s 10% tariffs on Chinese imports. These vital inputs are essential for new energy and advanced technologies, as well as for the broader commercial and defense industrial bases.

Another form of market manipulation happens when non-market actors dump low-cost minerals on the global market, leaving competitors unable to compete. For example, in 2023 a glut of low-cost lithium, cobalt, nickel, and graphite from Chinese-controlled firms flooded the market, dropping prices by 40-60%. The steep price drop impacted investments in new critical mineral projects; the only U.S. cobalt mine ceased work and the mine will likely remain closed until prices return to pre-dumping levels. More recently, the Department of Commerce launched an investigation into concerns that Chinese manufacturers’ overproduction of anode-grade graphite led to dumping margins of up to 920%. This type of market manipulation poses significant obstacles to boosting domestic critical mineral production.

Solving for the Problem

Policymakers are developing approaches to address the challenges complicating critical mineral supply chains: tight geological constraints of economically viable reserves, limited processing capacity stunted by long –lead times, and a dynamic, sometimes unpredictable, mineral market. President Trump’s EO included a focus on “Restoring America’s Mineral Dominance.” It directs agencies to address these challenges by increasing domestic mapping efforts, reducing regulatory burdens, expanding access to federal funding, optimizing use of existing defense stockpiles, countering unfair trade practices, and other measures.

Working more closely with international partners can complement the administration’s domestic focus. Known reserves in the U.S. are inadequate even for current demand. While mapping may uncover more viable resources, it takes 29 years to bring a new minerals mine on-line in the U.S. Luckily, robust reserves of most critical minerals have already been identified in market-oriented countries, such as Argentina, Poland, and Australia. Collaborating with trading partners and allies can produce a more potent response to the existing Chinese stranglehold on mining and processing.

The U.S. has already sown the seeds of deeper collaboration through programs like the Critical Mineral Agreement with Japan, the Mineral Security Partnership, and a first-term Trump initiative, the Energy Resource Governance Initiative. Secretary of Interior Doug Burgum reaffirmed the notion of working with international partners at his confirmation hearing stating, “we have to have a security network of people that are truly our allies. And we have to be able to buy and sell from each other around these critical minerals.”

Wilson Center, Geographic Concentration of Critical Minerals Reserves and Processing, September 28, 2022

There are multiple Congressional efforts to do just that. The Critical Mineral Security Act of 2025, a bipartisan bill introduced by Senator John Cornyn (R-TX) and a bipartisan group of colleagues, lays the foundation for more strategic and robust international partnerships in the critical minerals sector.

In addition, the Securing Trade and Resources for Advanced Technology, Economic Growth, and International Commerce in Minerals Act (STRATEGIC Act), reintroduced by Senator Young (R-IN) and co-sponsored by Senators Coons (D-DE), Cornyn (R-TX), and Hickenlooper (D-CO), authorizes the president, through the U.S. Trade Representative, to negotiate trade agreements on critical minerals and rare earth elements with trusted partners. Such agreements would diversify supply, allowing the U.S. and partners to supplement domestic production efforts, expand access to critical minerals, and limit the risks of market manipulation. It is crucial to remember that our international partners are grappling with the same market dynamics and will likewise be looking for tools to improve security of supply, making trade a crucial opportunity for U.S. leadership.

The U.S. must continue to explore all available tools to improve supply chain security. While many efforts are designed to increase domestic mining and processing, policymakers cannot overlook the promise of international partnerships to increase supplies and mitigate market manipulation. One additional component of policy remains: research, development, and innovation to reduce or replace critical mineral inputs for commercial and defense technologies. We’ll explore this area in future work.