In September, we released the report Carbon Import Fees and the WTO, a first-of-its-kind legal analysis of how different climate and trade policy proposals might fare if challenged by member countries of the World Trade Organization (WTO). These policy mechanisms are being increasingly looked at as a way to address the carbon loophole—the 20-25 percent of global greenhouse gas emissions associated with internationally traded goods.

With governments around the world—including the U.S. Senate, which has introduced legislation related to carbon import fees—considering a range of trade and climate approaches, our analysis is intended to shed light on which policy tools could withstand expected WTO scrutiny.

Key Takeaways

- Our research shows that a case can be made to defend each of the various proposed approaches to carbon import fees.

- Motives for implementing carbon import fees can be economic and/or environmental in nature.

- The EU’s Carbon Border Adjustment Mechanism, which recently entered its transitional period, will likely face WTO scrutiny—and the EU has an interest in promoting interpretations that will allow various policy approaches to proceed.

- Carbon import fees linked to explicit domestic carbon fees are likely to be permissible without providing the justification the other policy mechanisms may require.

Forms of Carbon Import Fees

Several different carbon import fee mechanisms are on the table. Our research breaks down these options and analyzes their prospects before the WTO.

- Border adjustments of explicit domestic carbon prices would charge imports at the same rate that domestically produced goods are charged under a domestic carbon price, such as a carbon fee or an emissions trading system (ETS). An example includes the EU’s CBAM, the first major carbon border adjustment of any domestic carbon price.

- Border adjustments of implicit carbon prices imposed by domestic climate policies reflect the cost of complying with domestic regulations which reduce greenhouse gas emissions. This approach is taken in the FAIR Transition and Competition Act, introduced by Senator Chris Coons (D-DE) and Representative Scott Peters (D-CA-50) in July 2021.

- Emissions intensity-based import fees, which assess charges on imported products based on emissions intensity but without linking the charge to any specific domestic policies. This is the approach proposed in Senator Bill Cassidy’s (R-LA) Foreign Pollution Fee Act and the Global Arrangement on Sustainable Steel and Aluminum, a trade deal that the U.S. and EU are currently negotiating.

- Punitive carbon tariffs are high, economy-wide tariffs applied to countries that are not adequately participating in international climate efforts, an approach proposed by Nobel laureate William Nordhaus.

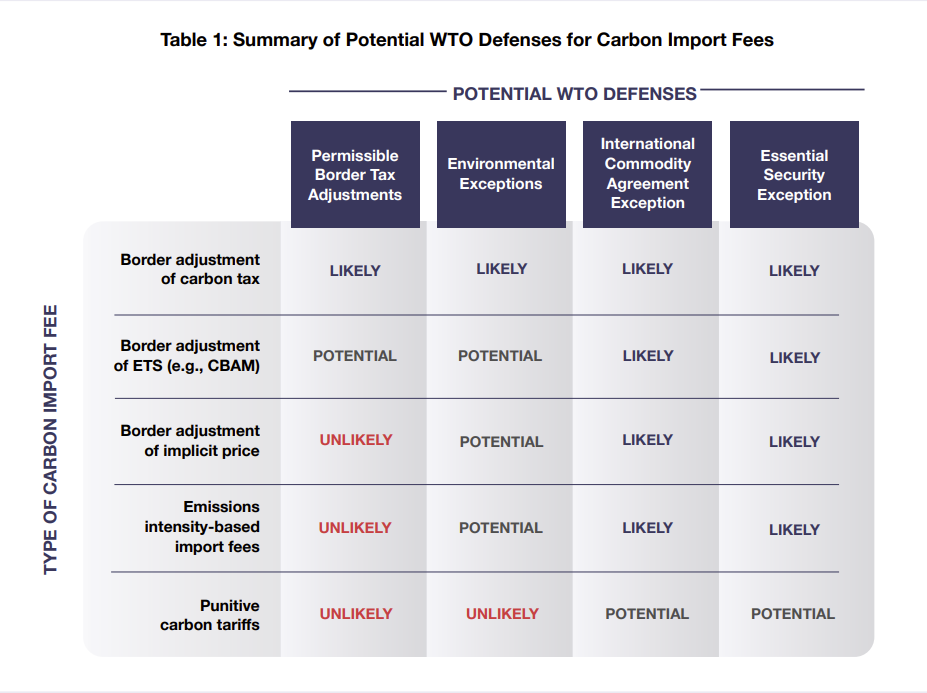

Potential WTO Defenses

We studied the suite of WTO defenses available to each of these policy proposals and relevant precedent to guide our analysis. What we found: any form of carbon import fee proposed to-date has a plausible defense rooted in the General Agreement on Tariffs and Trade (GATT), a long-standing WTO agreement.

- Permissible Border Tax Adjustments: In short, a carbon import fee that applies a domestic indirect tax, like a carbon fee, to imported products would be permissible without the need to invoke exceptions.

- The Environmental Exceptions: Environmental exceptions could be invoked to justify a range of policies, including adjustments for a domestic emissions trading system, like the CBAM; domestic regulatory costs; or emissions intensity import fees. This is especially true if border policies are implemented in conjunction with domestic approaches to reduce emissions.

- The Intergovernmental Commodity Agreement (ICAs) Exception: Largely untested as a WTO defense, ICAs (agreements between governments to regulate trade in specific commodities) could provide a broad source of protection for all approaches to carbon import fees.

- The Essential Security Exception: Should a country effectively demonstrate that climate change constitutes an emergency in international relations—certainly conceivable given the decades of international engagement and long-standing concerns expressed by the national security apparatus—this exception could support all forms of carbon border fees.

Our assessment of viable defenses for each carbon import fee approach is summarized in the chart below.

Conclusion

While the outcome of any WTO dispute(s) regarding carbon import fees will depend on the specific policy or policies in question and the interpretation of the Appellate Body (if reconstituted), our analysis clearly shows there are viable pathways for defending a variety of approaches to carbon border fees.

With bipartisan interest in carbon border fees growing in the U.S.; policies like the CBAM already being phased in by the EU; and the first ever “trade day” scheduled to be part of COP28, the international climate conference in Dubai later this year, all signs point to climate and trade policy remaining a robust focus of conversation and action for the foreseeable future.