The Council’s research in Prioritizing American Interests articulated a $130 trillion global market opportunity for clean energy technologies through 2050. This market is fueled in part by developing economies eager to build out their energy systems to support rapid economic growth; developing economies will drive an estimated 65% of global economic growth over the next decade. The U.S. must compete for access to these large, growing, and lucrative markets.

Our Center for Climate & Trade recently sent letters to Congress suggesting that the U.S.’s foreign assistance and investment toolkit can be improved to support U.S. firms and investors, American manufacturers, supply chain security, and durable geopolitical influence. To understand the stakes, we must better appreciate the contours of the global energy trade, examining where the U.S. stacks up against competitors for global energy exports. The following analysis suggests that the U.S. enjoys a dominant position in some portions of the energy export market but has ceded significant and growing portions of this market opportunity to Chinese firms—at least to-date.

The U.S. is a Major Energy Exporter to Emerging Markets

The most significant competitor to American firms in global energy exports is China, whose Belt and Road Initiative has invested over $1 trillion, primarily in developing economies; 40% of that investment went to the energy sector.

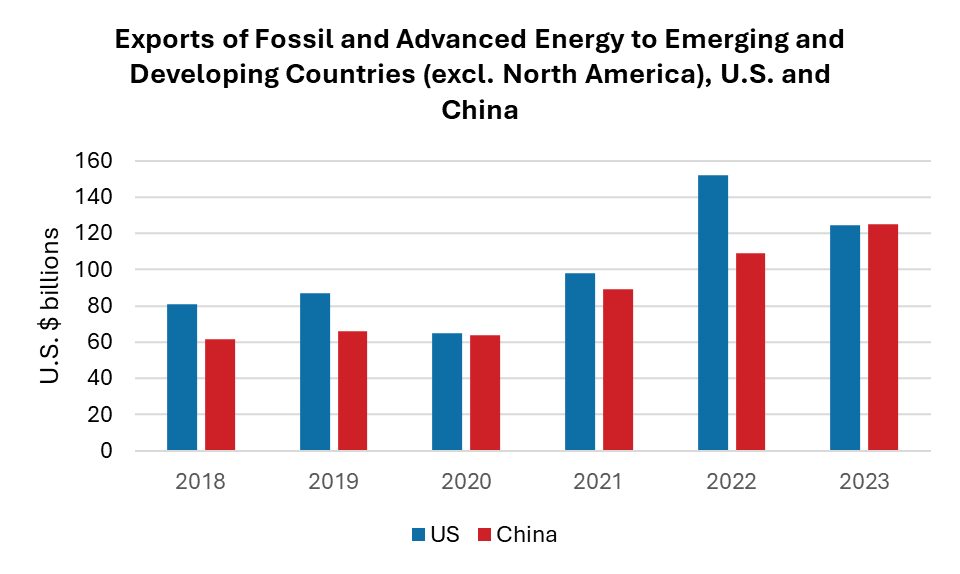

A comparison of U.S. and Chinese energy exports to developing countries1—including both fossil fuels and associated equipment as well as advanced energy technologies2—shows that the U.S. has historically out-exported China. This is largely thanks to abundant U.S. oil and gas; the U.S. has been a net energy exporter since 2019 and is a vital supplier to global petroleum and LNG markets. The gap between the U.S. and China, however, has narrowed significantly. In 2023, China out-exported the U.S. in energy and energy technologies for the first time.

Source: The Observatory of Economic Complexity, author calculations

Shifting Global Energy Investment Trends

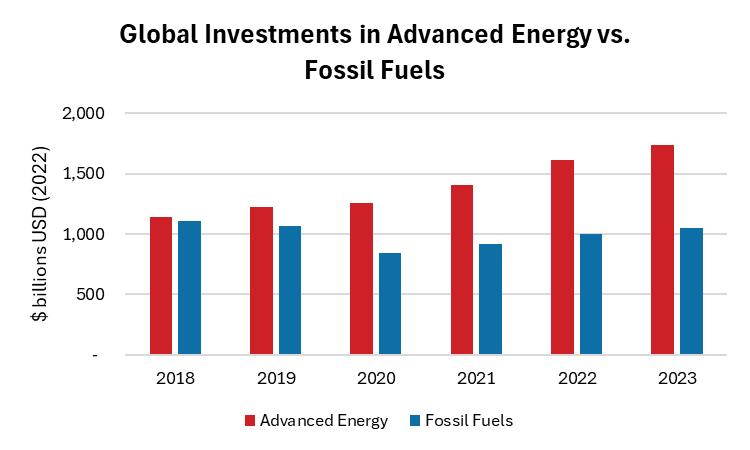

The context of China’s ascendance as an energy and energy technology export superpower is straightforward: global energy investment trends are shifting rapidly to areas of Chinese dominance. In 2018, worldwide investments in advanced energy and fossil fuels were virtually even. Over the next five years, however, investments in advanced energy increased by 53% whereas those in fossil fuels decreased by 5%. While fossil fuel investments still play a significant role in the global economy, the worldwide market for advanced energy investments is now more than 65% larger than the market for fossil fuel investments and is growing rapidly.

Source: The International Energy Agency

The U.S. is Falling Behind on the Technologies of the Future

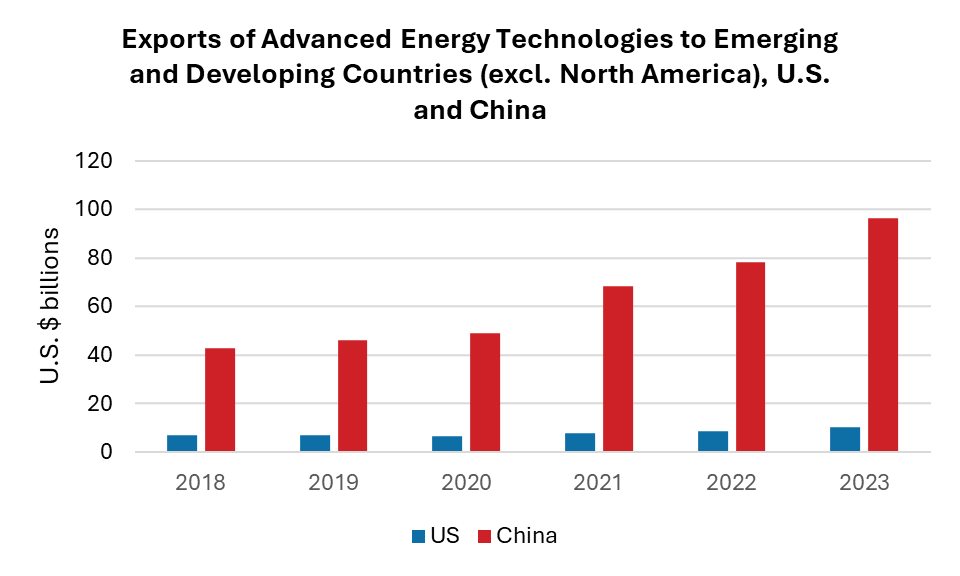

As the global economy shifts to advanced energy solutions, China is enjoying the pole position. Between 2018 and 2023, Chinese exports of advanced energy technologies to emerging economies increased by $54 billion, or 125%, to $96 billion. Over the same period, American exports of the same goods increased by just $3.3 billion to $10 billion.

Source: The Observatory of Economic Complexity, author calculations

The significant increase in advanced energy exports from China is not happenstance but rather the result of dedicated policy action by the Chinese Communist Party (CCP), which has been ramped up in recent years. In 2021, President Xi Jinping announced that China would “step up support in other developing countries in developing green and low-carbon energy,” launching a concerted effort by the CCP to lead the developing world in the “transition to green and low-carbon production and consumption.”

A Concerning Reality if Left Unaddressed

The data is clear: in the fastest growing energy technology markets in rapidly growing developing countries, China is vastly out-competing U.S. firms. As energy investment and export trends continue and the demand for advanced energy technologies rapidly increases, the U.S. will be ill-positioned to maintain dominance in the energy export economy of the future. The U.S. cannot afford to cede this tremendous market opportunity to Chinese firms. The good news: the race to access these markets will span several decades and we are still in the early days. The U.S. boasts the world’s largest economy, most dynamic capital markets, and an unparalleled track record in technological innovation. The U.S. can win the race—if manufacturers and the government act with urgency and strategic focus.

1 Emerging and developing economies as defined by the International Monetary Fund. This analysis excludes Mexico given the unique interconnectedness of the North American market and excludes China.

2 Advanced energy technologies include those related to electricity infrastructure, nuclear power, carbon capture, renewable energy, electric vehicles, energy storage, heat pumps, and hydrogen.