The U.S. built the first nuclear reactor and dramatically outpaced global competitors in innovation and deployment in the earliest days of the civilian nuclear energy industry. Even today, the American nuclear fleet supplies nearly 20% of American electricity demand with reliable, emissions-free power.

Building on that historic record, American policymakers are aiming to usher in a nuclear energy renaissance. The goal is timely. International competitors are building more nuclear energy at home and exporting more technologies and equipment abroad, cementing long-term commercial and diplomatic relationships around the globe at a time when nuclear demand is growing. In 2023, 25 countries pledged to triple their nuclear energy capacity by 2050, and analysis suggests that up to 70 countries will become viable markets for advanced nuclear over the next 25 years.

As countries build nuclear capacity, especially developing countries without existing programs, there will be a tremendous market opportunity for firms looking to export nuclear designs, equipment, and services. And American firms—leaders in cutting-edge, innovative technologies—are developing and deploying new designs for advanced nuclear energy technologies.

This blog explores the international landscape and the market dynamics that U.S. firms will be competing against.

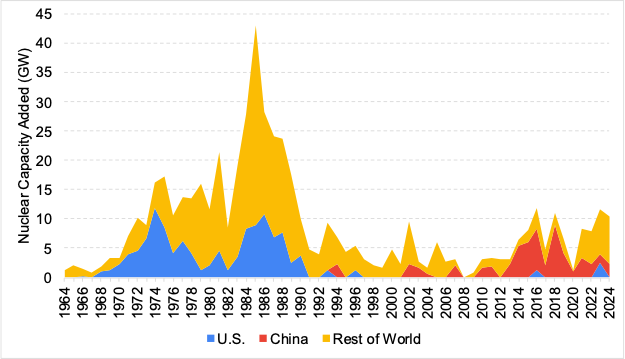

The U.S. has fallen behind in nuclear energy construction

The U.S. was once the world leader in nuclear energy and deployed large, efficient nuclear facilities at a rapid clip. Many of those reactors—largely built in the 1970s and 1980s—are still in operation today. Despite this, the U.S. has fallen significantly behind competitors in building new nuclear reactors in recent decades. Since 2000, seven countries have added more nuclear capacity than the U.S.: China (15x U.S. capacity), South Korea (5x), Russia (3x), France (2x), India (2x), Japan (1.5x), and the UAE (1.5x). Over the same period, the U.S. has added just 5.7GW of nuclear capacity and retired twice as much.

Figure 1: Nuclear Energy Capacity Added by Year

Source: Global Energy Monitor, author calculations

The Trump administration has taken early steps to reassert American dominance in nuclear energy. In May, President Trump released a series of executive orders that included plans to expand U.S. domestic nuclear energy capacity from 100GW to 400GW by 2050 by streamlining licensing, cultivating the domestic workforce, and rapidly deploying reactors. Additionally, the orders directed U.S. agencies such as the U.S. International Development Finance Corporation (DFC), the Export-Import Bank of the United States (EXIM), and the U.S. Trade and Development Agency (USTDA) to promote and facilitate U.S. nuclear exports abroad.

Also this year, the World Bank ended its 60-year prohibition on funding for nuclear energy projects, opening the door to Bank support of civilian nuclear projects across the globe. Other institutions, such as the Asian Development Bank, appear ready to follow suit.

Competitors dominate the nuclear export landscape

Two countries presently dominate the international nuclear market: China and Russia. China leads in the domestic construction of nuclear reactors, and the Chinese Communist Party aims to sell 30 Chinese-designed reactors to Belt and Road Initiative (BRI) countries by 2030. Russia dominates the global nuclear design market. Of the 59 nuclear reactors under construction globally, 26 use technology supplied by Russia, including reactors in China, India, Egypt, Turkey, Bangladesh, Iran, and Slovakia. France is supplying the designs for two U.K. reactors, and China, India, South Korea, Argentina, and Japan are relying on domestic designs. No overseas reactors—and no new large-scale reactors—are being constructed using American designs.

Figure 2: Design Origins of Nuclear Reactors Under Construction

Source: The World Nuclear Industry Status Report 2024

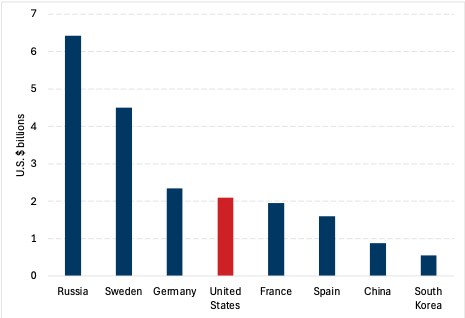

Russia also dominates global exports of nuclear equipment, followed by Sweden, Germany, and the U.S. (see Figure 3). Notably, while the U.S. is among the top 5 countries in nuclear equipment exports, nearly all U.S. exports are shipped to other advanced economies. Russia and China ship the bulk of their exports to emerging economies. For example, Belarus, Iran, and Ukraine were among Russia’s top 5 export destinations prior to Russia’s full-scale invasion of Ukraine in 2022.

Figure 3: Global Exports of Nuclear Equipment by Major Exporter, 2018-2023

Source: Observatory for Economic Complexity, author calculations

The U.S. can compete and assert energy dominance through government action and private innovation

Data demonstrates that the U.S. lags behind competitors in global nuclear energy trade, with limited domestic construction, design exports, and equipment exports. The administration’s focus on reviving a robust American nuclear industry and seizing the growing nuclear market opportunity is timely.

American firms have been extremely active in innovating next-generation nuclear technologies, particularly small modular reactor (SMR) technologies. There are at least 22 different American designs in the works, more than any other country. SMRs are especially appealing to emerging economies due to the relatively smaller initial capital investment that is required, reduced construction times, greater scalability, and more geographic flexibility compared to larger reactors. Although Russia and China have each already operationalized a commercial SMR. As the Trump administration works to promote faster development of SMRs at home, it may also consider how the government can help companies license and export these technologies, as the U.S. cannot afford to cede overseas market share in this novel nuclear technology as well.

Despite strong headwinds from competitors, the growing global market for nuclear energy represents a significant market opportunity for the U.S. and American innovators. Concrete action to enhance U.S. nuclear technology exports by pairing effective government policies with private innovation stands to benefit U.S. industry, emerging economies, and the global climate.