The big story right now in the U.S. electricity sector is a surge in demand—also known as “load growth”—driven by accelerating investment in new data centers, the expansion of advanced manufacturing, and the widespread electrification of transportation and buildings. The U.S. Department of Energy recently estimated that data centers alone could increase U.S. electricity load by between 330 and 580 terawatt-hours (“TWh”) by 2028. That pace of load growth would bring total data center load to between 7% and 12% of U.S. electricity consumption.

Electrification, investments in domestic manufacturing, and the rush of load from data centers—unanticipated only a few years ago—have been part of hundreds of billions of new U.S. investments and are essential for winning the AI race and for the next generation of advanced energy technologies. It also creates new challenges for businesses, policymakers, and grid operators to ensure adequate power resources exist to meet system demand.

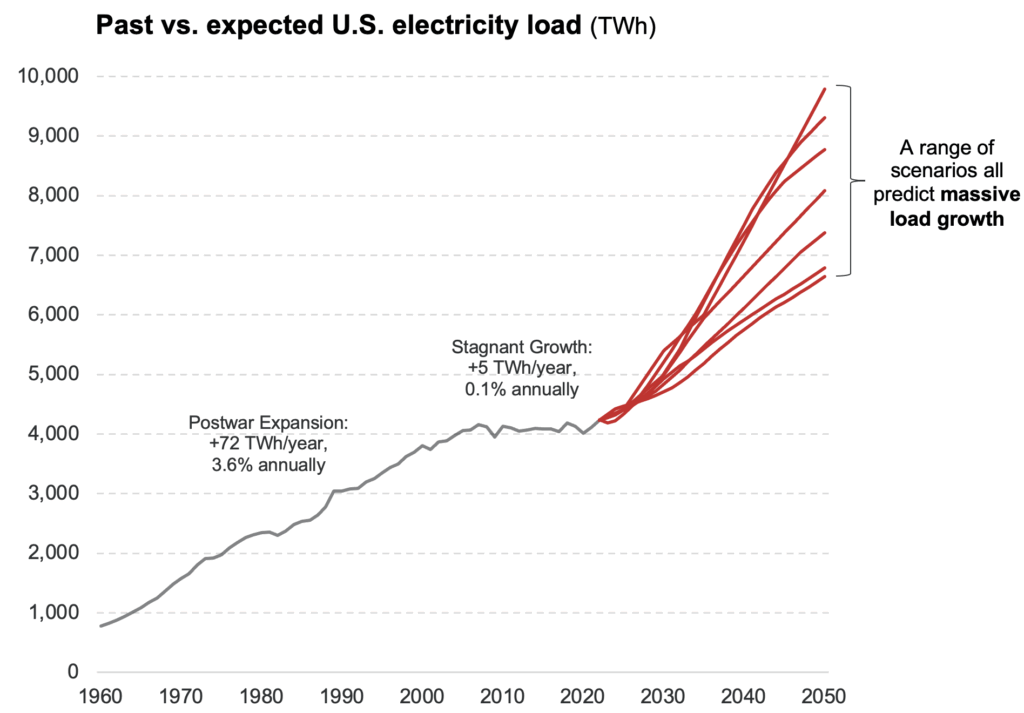

The only certainty: we’re headed for a drastic shift from 15 years of negligible growth.

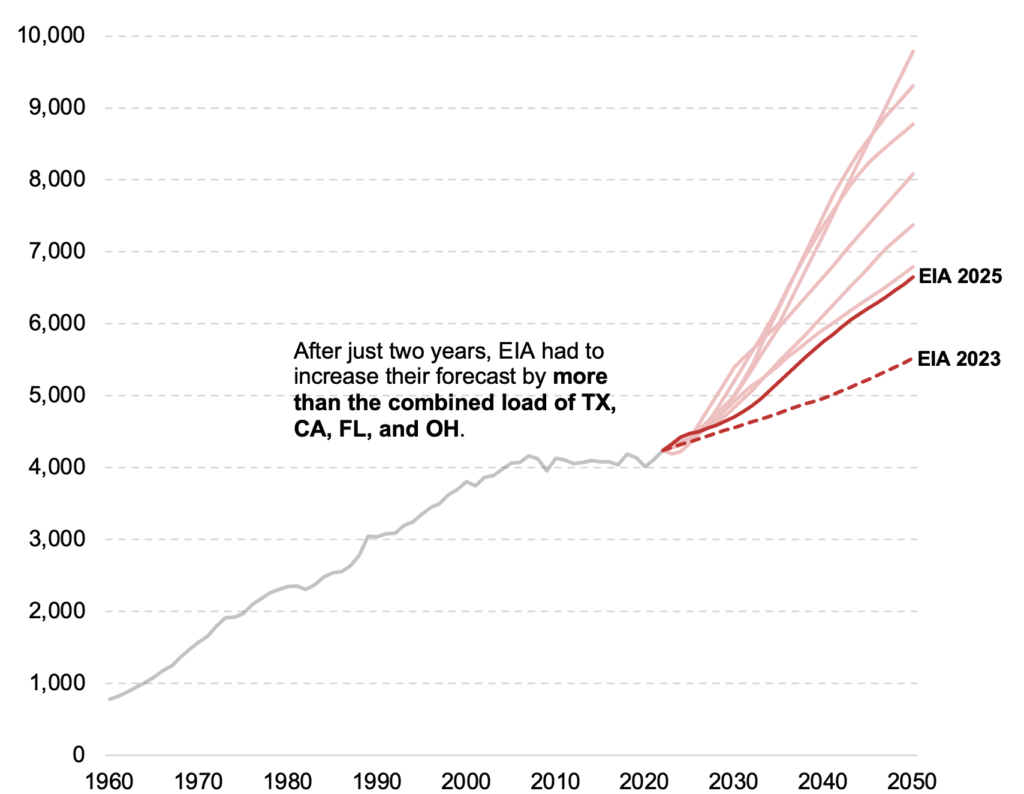

While it became clear as early as 2021 that we had entered a new paradigm, the scale of future load growth remains highly uncertain. Expert forecasters continue to revise their estimates upward every year we move deeper into this shift.

The range of potential outcomes driven by new technology shows the revolution in the U.S. electricity sector is just beginning. The challenges for utilities and policymakers will be to balance customer access to affordable, reliable electricity while servicing rapid load growth. Federal, state, and local policy will need to accommodate new plants and transmission and distribution infrastructure, and utilities and regulators must conduct careful analysis to ensure resource adequacy, shorter lead times, and other improvements.

Still, rising electricity demand reflects renewed growth. American industry will be called upon to provide the materials, equipment, and services to upgrade and maintain the system. Providers of energy services and technologies will have new and expanding opportunities to meet domestic demand. Rapidly increasing demand will provide powerful incentives that can accelerate the development of next-generation clean energy technologies. Investment in data centers, electrification throughout the economy, and infrastructure can be profound drivers of domestic economic growth—if the policy environment can move quickly and decisively to support the market.

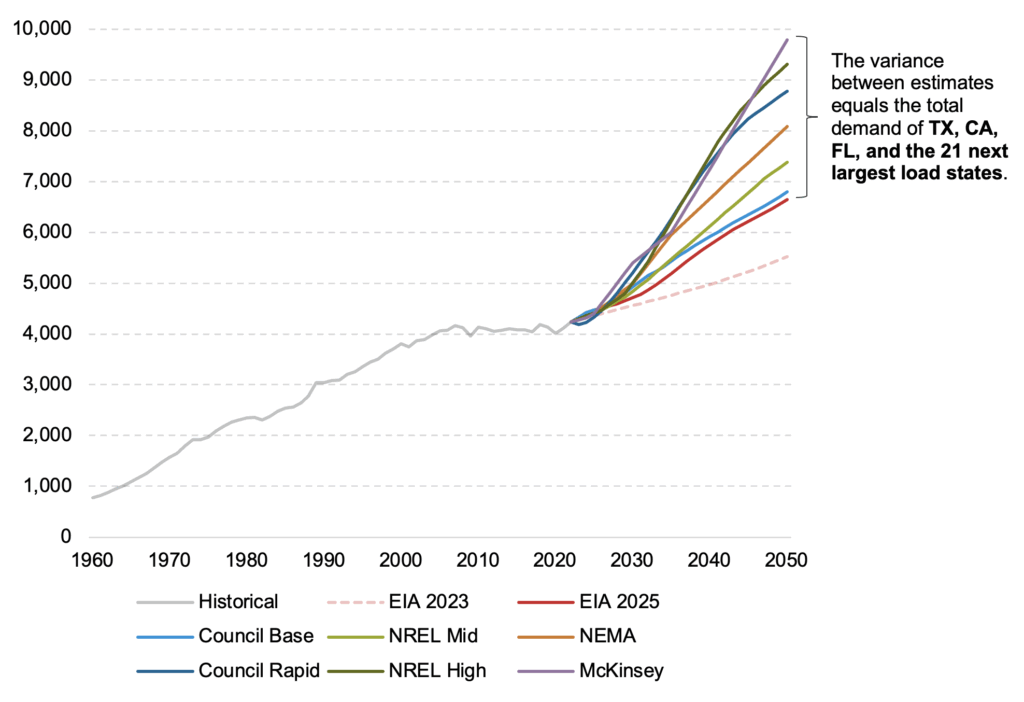

The data above shows historical load from 1960 through 2022—a span including consistent growth postwar through 2007, followed by a period of stagnation. Eight scenarios demonstrate the wide range of potential outcomes for load growth through midcentury. Comparing scenarios, the projected demand increase is clearly large and highly uncertain.

- EIA (2023) – In 2023, EIA projected U.S. load would increase by an average of 46 TWh per year through 2050.

- EIA (2025) – EIA recently increased its 2050 load forecast by roughly 1,125 TWh in 2050 compared to EIA (2023), anticipating striking investments in data centers. The updated annual increase is now more per year (86 TWh) than cumulative load growth observed during the stagnate period (only 72 TWh).

- Council Base – The Council constructs its Base Case from a variety of sources, which include EIA (2025), the U.S. Department of Energy study on data center load, as well as from Bloomberg New Energy Finance (“BNEF”). The Base Case suggests load growth of 91 TWh per year (or at a 1.7% compounded rate).

- NREL Mid – The National Renewable Energy Laboratory (“NREL”) releases “standard scenarios” for load growth based on permutations for economic and population growth, electrification, and energy efficiency. The NREL “Mid” scenario projects load growth of 112 TWh each year.

- NEMA – The National Electrical Manufacturers Association (“NEMA”) is the association representing electrical equipment manufacturers. The NEMA load forecast comes down in the middle of the seven forecasts, excluding EIA (2023).

- Council Rapid – The Council “Rapid” scenario includes anticipated data center load alongside further waves of electrification in space and water heating, industry, and transportation. It suggests load growth of 162 TWh per year.

- NREL High – NREL modeled U.S. load growth with maximalist electrification through 2050 and arrived at yet-higher projections. In their analysis, load increases by 181 TWh per year—or adding more than Ohio’s current load every year.

- McKinsey – Consultancy McKinsey & Company released a load forecast with similarly accelerated electrification rates to Council Rapid and NREL High, but introducing even more demand through large-scale hydrogen production.