Yesterday, the president signed the Consolidated Appropriations Act, 2026, which includes fiscal year 2026 (FY26) funding for “National Security, Department of State, and Related Programs”—the main appropriations vehicle for the key agencies involved in commercial diplomacy, market making, project preparation, economic assistance, infrastructure, project finance, and export finance. Adequately resourcing these agencies is essential to a whole-of-government approach to helping U.S. businesses and workers compete overseas.

The Council views a well-coordinated, whole-of-government international investment and export strategy as essential for developing global markets, granting U.S. advanced energy innovators access to those markets, securing important supply chains for manufacturers, and creating more demand pull for greater technological innovation—all of which will support lowering global emissions.

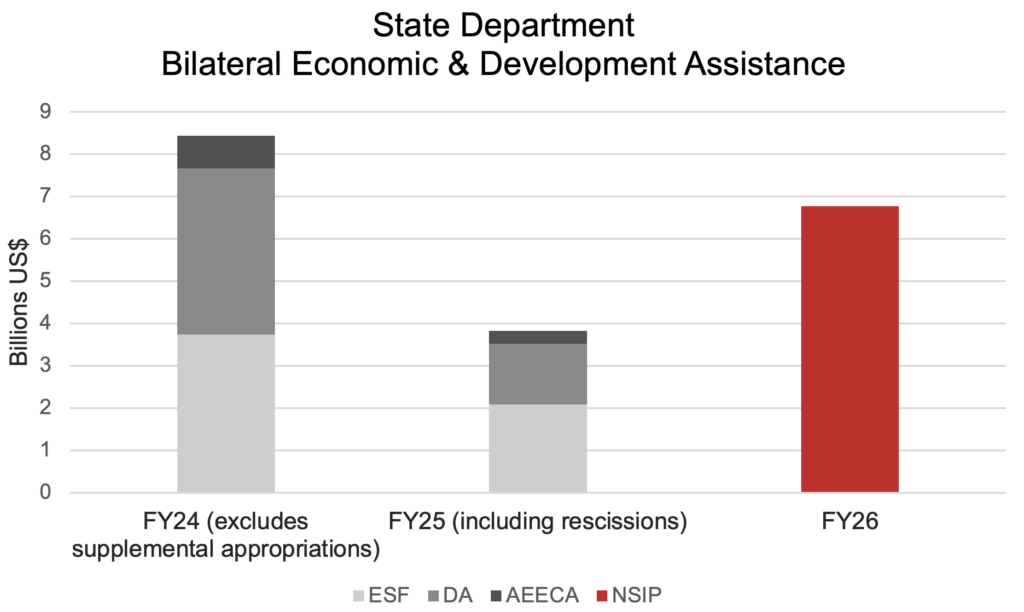

Following a FY26 budget request from the administration to substantially reduce funding for foreign affairs programs and agencies, bipartisan negotiations resulted in top-line funding levels for these programs being roughly $9.3 billion (16%) below levels provided under the FY25 full-year continuing resolution (CR). This comparison is complicated, however, by the Rescissions Act of 2025, which clawed back nearly $7.7 billion of foreign affairs funding, reducing FY25 economic and development assistance levels by over $4.6 billion from the CR level.

With these complications in mind, the sections below unpack what is included in the latest appropriations bill compared with prior years.

State Department Economic and Development Assistance

The bill modifies how bilateral economic and development assistance is administered and accounted for. It consolidates three legacy accounts—the Economic Support Fund (ESF), Development Assistance (DA), and Assistance for Europe, Eurasia, and Central Asia (AEECA)—into a new State Department-run program called the National Security Investment Programs (NSIP). The bill provides $6.8 billion for NSIP. This is 77% higher than FY25 funding for ESF, DA, and AEECA after rescissions, but still 20% below FY24 levels.

NSIP grants will be used to support a wide range of economic and development programs, including energy and economic development, water, sanitation, education, agriculture, democracy, human rights, and more. Given that the administration has said it will “invest in activities that advance U.S. economic interests,” it’s likely to focus on funding economic and energy projects with a direct connection to the United States. That said, Congress provided substantial earmarks and guidelines that direct funds for certain regions, countries, and initiatives including:

- At least $1 billion for programs in Africa.

- At least $500 million to support certain countries in Europe, Eurasia, and Central Asia.

- At least $185 million of assistance for energy development and security programs that improve energy access, productivity, and self-reliance (This may include funds outside of NSIP).

- At least $155 million to support the Economic Resilience Initiative (ERI) to enhance the economic security and resilience of the U.S. and partner countries through support for infrastructure, critical mineral, and digital projects (ERI funds may be transferred to EXIM, DFC, and USTDA).

- At least $5 million to enhance coordination with the Department of Commerce.

- Congress also directs State to submit reports assessing opportunities to support allies and partners in the development and deployment of geothermal energy.

Although these funds have been appropriated, that doesn’t mean State will start spending money tomorrow. There is a multi-step process the administration must go through with Congress first, starting with State determining how resources will be allocated within congressional earmarks and guidelines. Most NSIP funds will not be formally committed until next year, and the actual disbursement of funds may occur over the course of several years.

DFC, EXIM, and USTDA

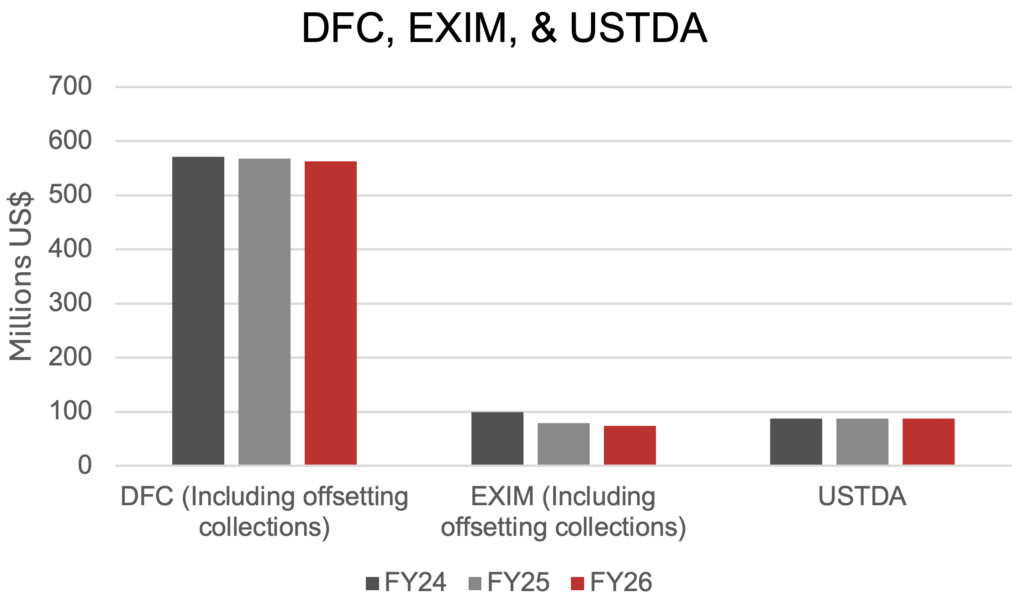

The bill keeps funding levels for the U.S. International Development Finance Corporation (DFC), the Export-Import Bank of the U.S. (EXIM), and the U.S. Trade and Development Agency (USTDA) relatively flat with FY24 and FY25 levels. We’ll note that because DFC and EXIM provide loans, loan guarantees, and other financing programs, the amount appropriated is only somewhat correlated with total credit activity performed. For example, EXIM anticipates that its $74 million in net appropriations will result in nearly $11 billion in credit activity. In a similar vein, USTDA touts its catalytic impact, noting that every dollar it programs results in $226 in U.S. exports.

Unlike NSIP, Congress did not provide heavy earmarks as to how DFC, EXIM, and USTDA allocate their resources. However, we can use the administration’s budget request and recent actions to predict how funding might be utilized.

- DFC received significantly expanded authorities in its recent reauthorization, including a substantially higher investment cap of $205 billion and increased ability to work in higher-income countries. DFC will use these new authorities to support energy, critical minerals, information and communications technology, transportation, and other projects. While Congress authorized a $5 billion “Equity Investment Account” to support equity investments in DFC’s recent reauthorization, appropriators did not explicitly provide funding for such a fund in FY26. Appropriators did express a willingness to work with DFC to support this fund in FY27, however.

- EXIM will likely focus on supporting energy exports, supply chain security, AI, critical minerals, and other advanced technologies. We anticipate EXIM will look to support overseas projects that will result in U.S. imports for vital commodities and products, such as last year’s $2.2 billion deal to support critical mineral projects in Australia. As policymakers look to reauthorize EXIM this year, we anticipate it becoming a more central piece of the administration’s toolkit.

- USTDA will likely focus on enabling infrastructure relating to energy, critical minerals, information and communications technologies, and transportation, with a particular focus on countering China’s economic influence.

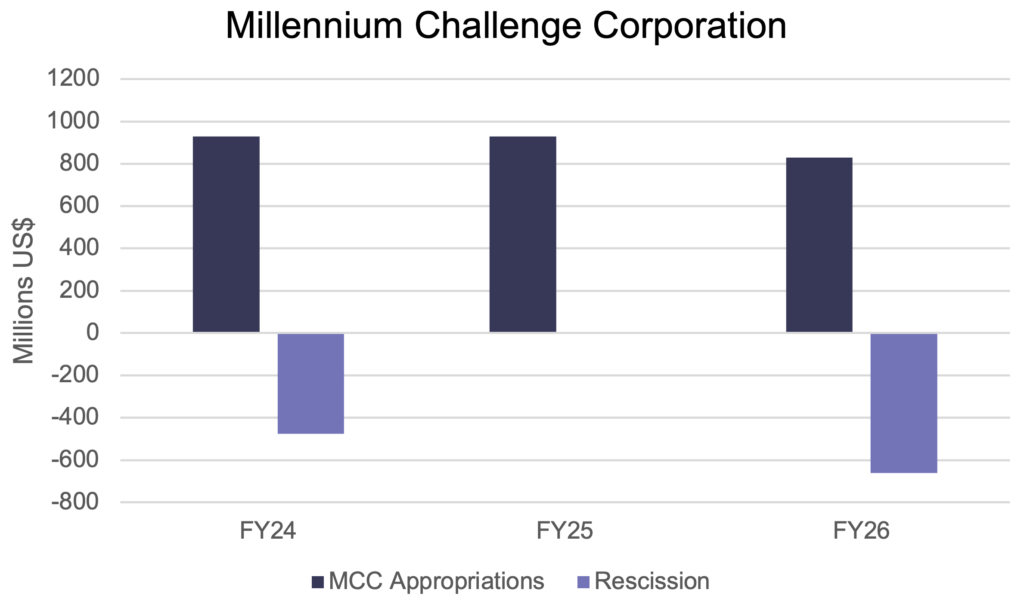

- MCC. The bill provides $830 million for the Millennium Challenge Corporation (MCC), which is $100 million—or 11%—below FY 24 and FY25 levels. The bill also claws back over $660 million of unspent existing resources from MCC through a rescission. While this rescission will have a large impact on existing MCC projects, in which resources are spent over the course of years, the new funding ensures that MCC will continue to operate and support new projects (called “compacts” or “thresholds”). MCC will likely focus on new projects in energy and private sector development, along with transportation and other infrastructure projects.

Multilateral Assistance

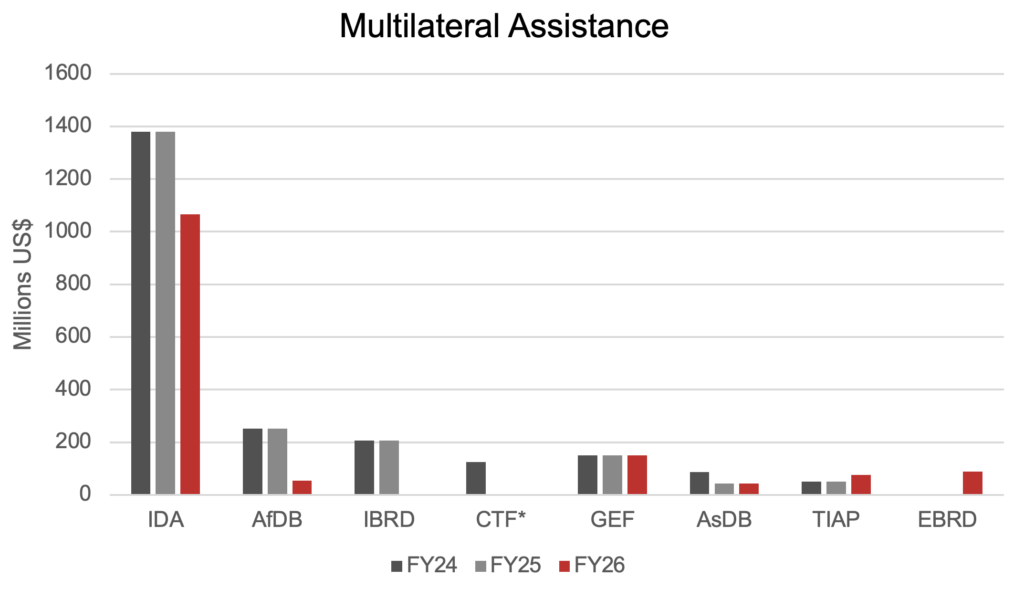

The bill contains cuts to funding provided to multilateral development banks and other institutions that support development and promote economic growth:

- The bill made large cuts or eliminated funding to the International Development Association (IDA), the African Development Bank Group (AfDB), the International Bank for Reconstruction and Development (IBRD), and the Clean Technology Fund (CTF).

- The bill maintained funding levels for the Global Environmental Facility (GEF) and the Asian Development Bank Group (AsDB). It added funding for the European Bank for Reconstruction and Development (EBRD).

- The bill increased funding for Treasury International Assistance Programs (TIAP) from $50 million to $75 million, giving the administration flexibility to fund new facilities at international financial institutions. We previously noted that the administration would be able to use TIAP loan guarantee authority help finance a new trust fund for nuclear energy at the World Bank. Although Congress eliminated TIAP’s guarantee authority in FY26, the administration might still use FY25 TIAP money to support such a fund.

*The Rescissions Act of 2025 rescinded $125 million of FY25 funding previously appropriated to CTF.

Notably, the bill contains numerous provisions to strengthen multilateral development bank support for nuclear energy:

- It directs Treasury to work with the EBRD, the IBRDs, and other multilateral development banks to lift restrictions on funding U.S.- and OECD-produced nuclear technologies, including small modular reactors (SMRs), and to strengthen the banks’ ability to assess nuclear projects in client countries.

- In line with our recommendations last year, the bill also directs Treasury to work with IBRD and other institutions to establish “Nuclear Energy Assistance Trust Funds” that aim to provide financial and technical assistance to support developing nuclear energy in borrowing countries.

The Council will continue to evaluate progress as these appropriations are carried out and develop proposals to maximize the use of scarce resources.