OVERVIEW

American firms make goods with fewer emissions than most countries in the world. We call this a carbon advantage. The more the global economy values lower-carbon production, the more U.S.-based businesses stand to win. And the more global supply can be met from U.S.-production, the more global emissions stand to fall. With the right policies in place, we can level the playing field and in doing so see U.S. manufacturers and workers come out ahead.

WHY IT MATTERS

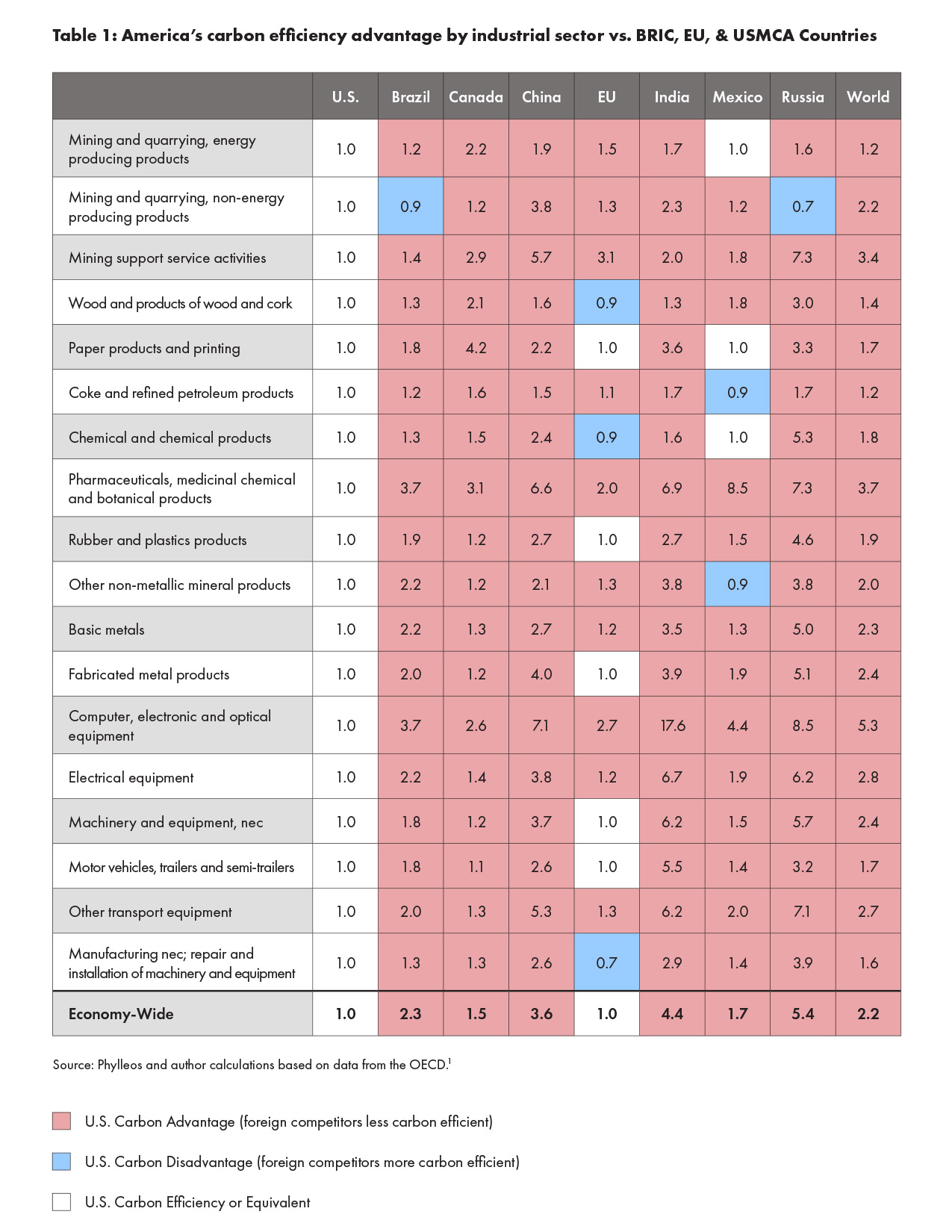

Goods manufactured in the U.S. are more than 2x more carbon-efficient than the world average. For example, the U.S. steel industry is 75–320% more carbon-efficient than global producers, depending on the product segment. U.S. chemicals manufacturers are 10-40% more carbon-efficient than the global average across five of the most common bulk chemicals. But today, U.S. manufacturers get no credit for producing goods with fewer emissions. To better understand these dynamics, the Council commissioned a model that tracks the carbon embedded in trade and calculates emissions. Weighted by economic output, this table reveals the relative carbon efficiency of production, by sector, across countries.

How a Carbon Advantage is Built

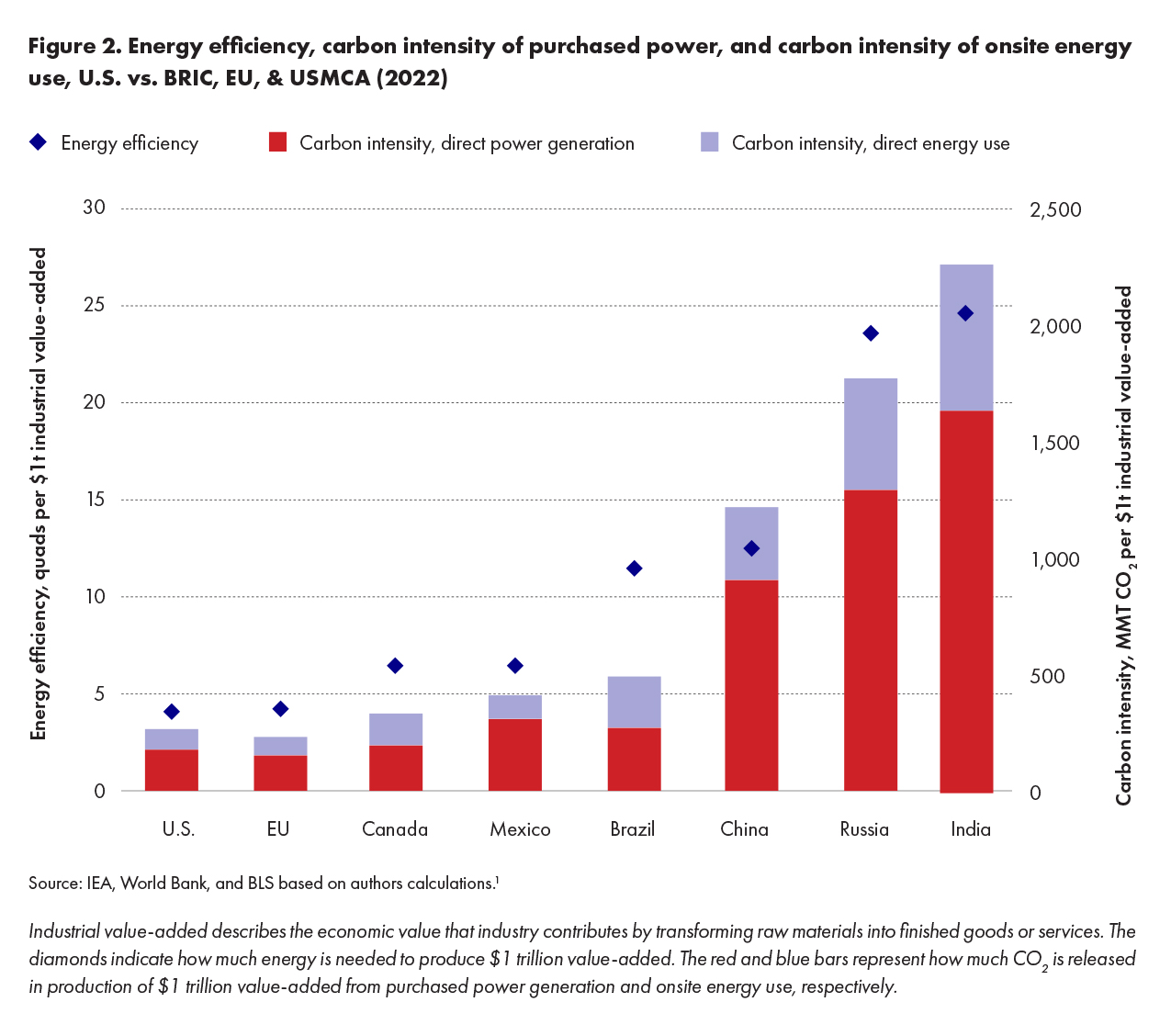

Economy-wide differences in the carbon intensity of production are driven mostly by three key factors: energy efficiency, electricity mix, and direct industrial energy use.

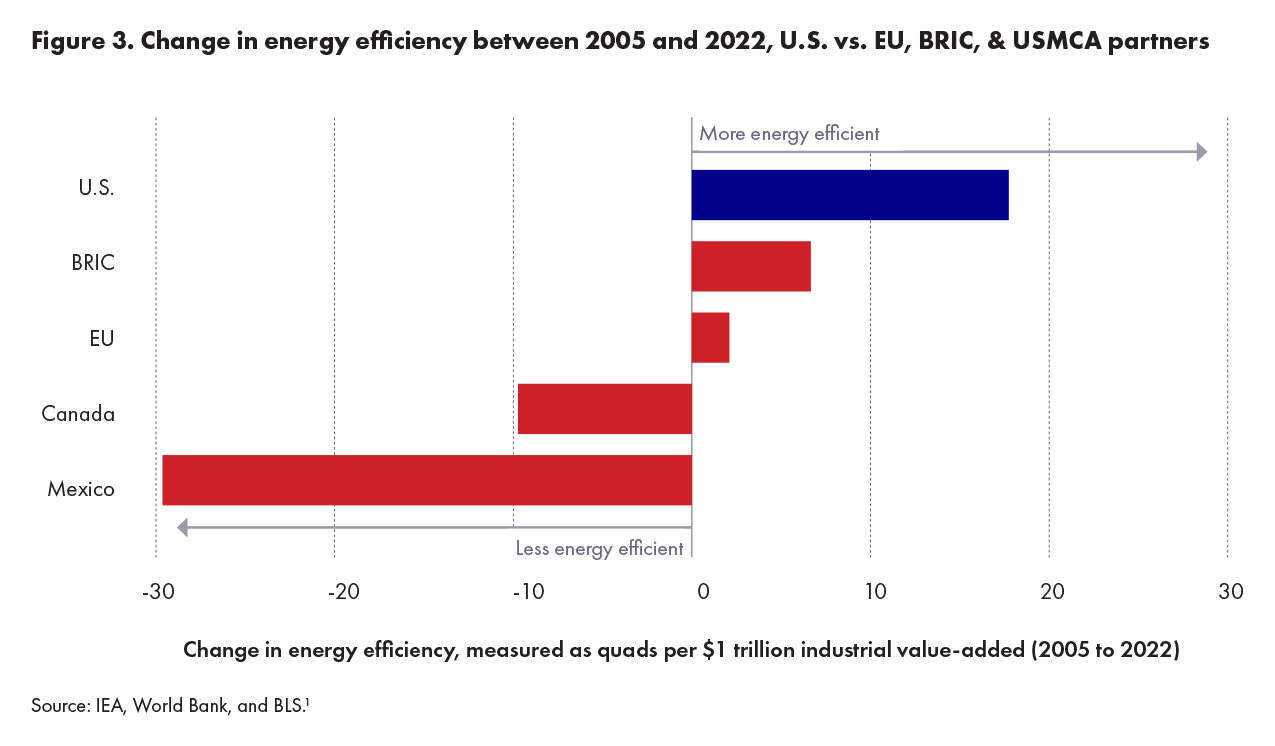

The U.S. has outpaced other economies in building its carbon advantage, investing in energy efficiency measures and improving its carbon efficiency dramatically over the last two decades.

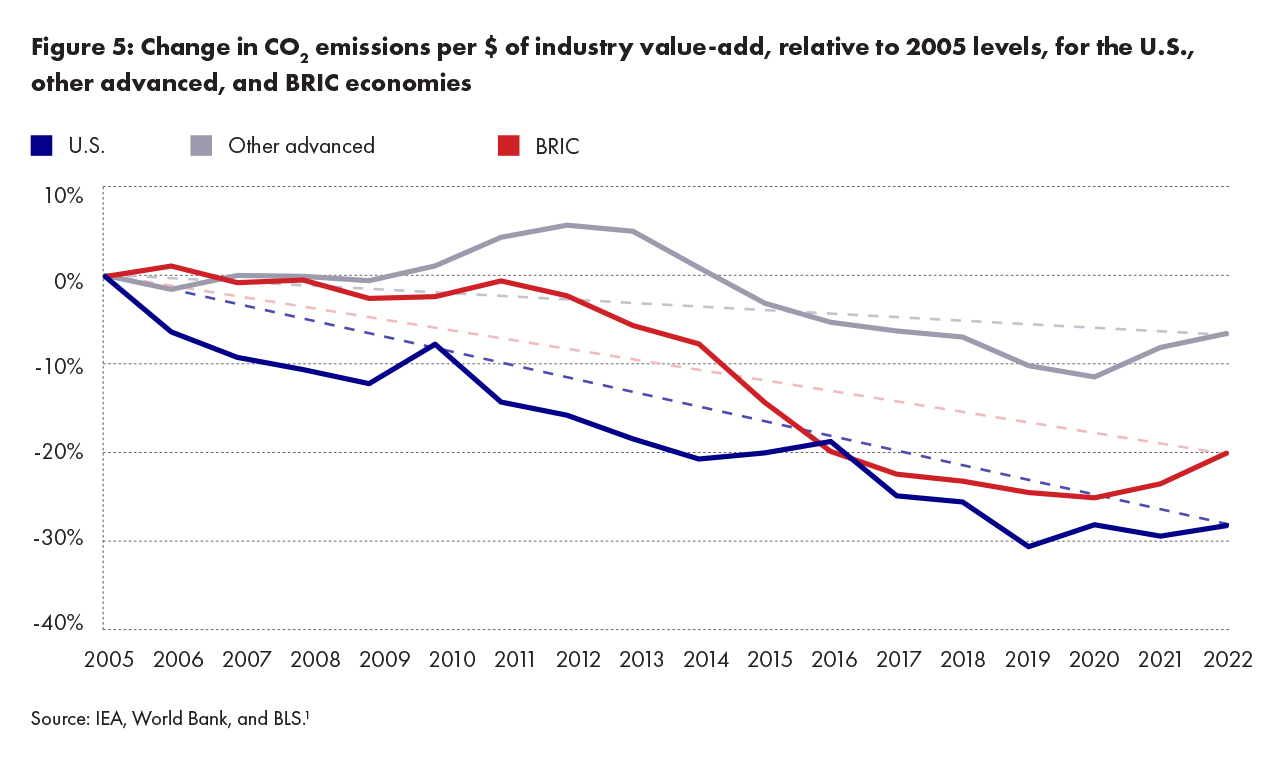

Tracking emissions per dollar over time lets us observe the cumulative impact of American investment in energy efficiency, grid decarbonization, and switching to lower-carbon fuels.

The U.S. Compared to China

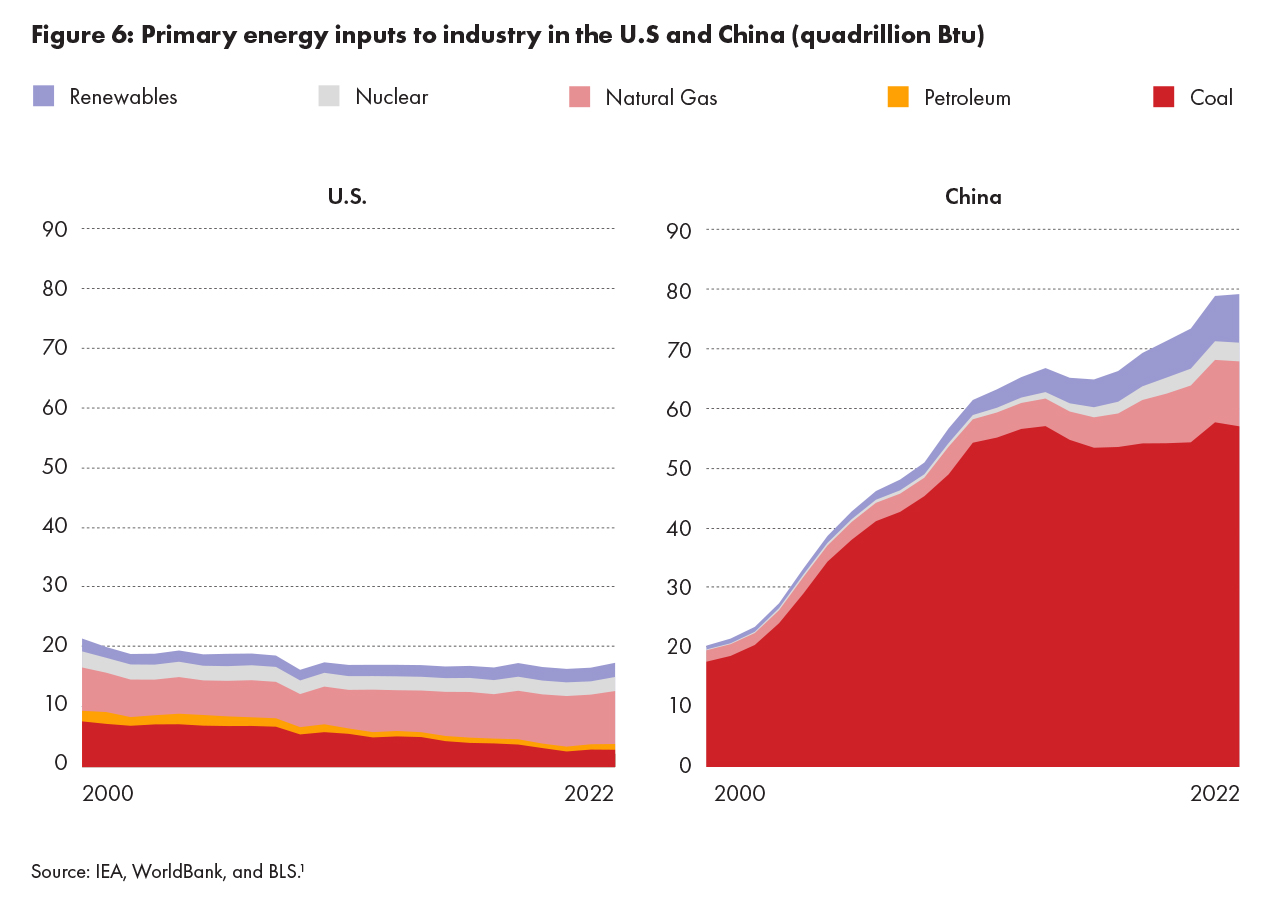

China and the United States are the first and second largest manufacturers in the world, respectively. U.S. made goods are about 4x more carbon-efficient than those manufactured in China. The biggest reason for this lies in how the two economies power their industrial sectors.

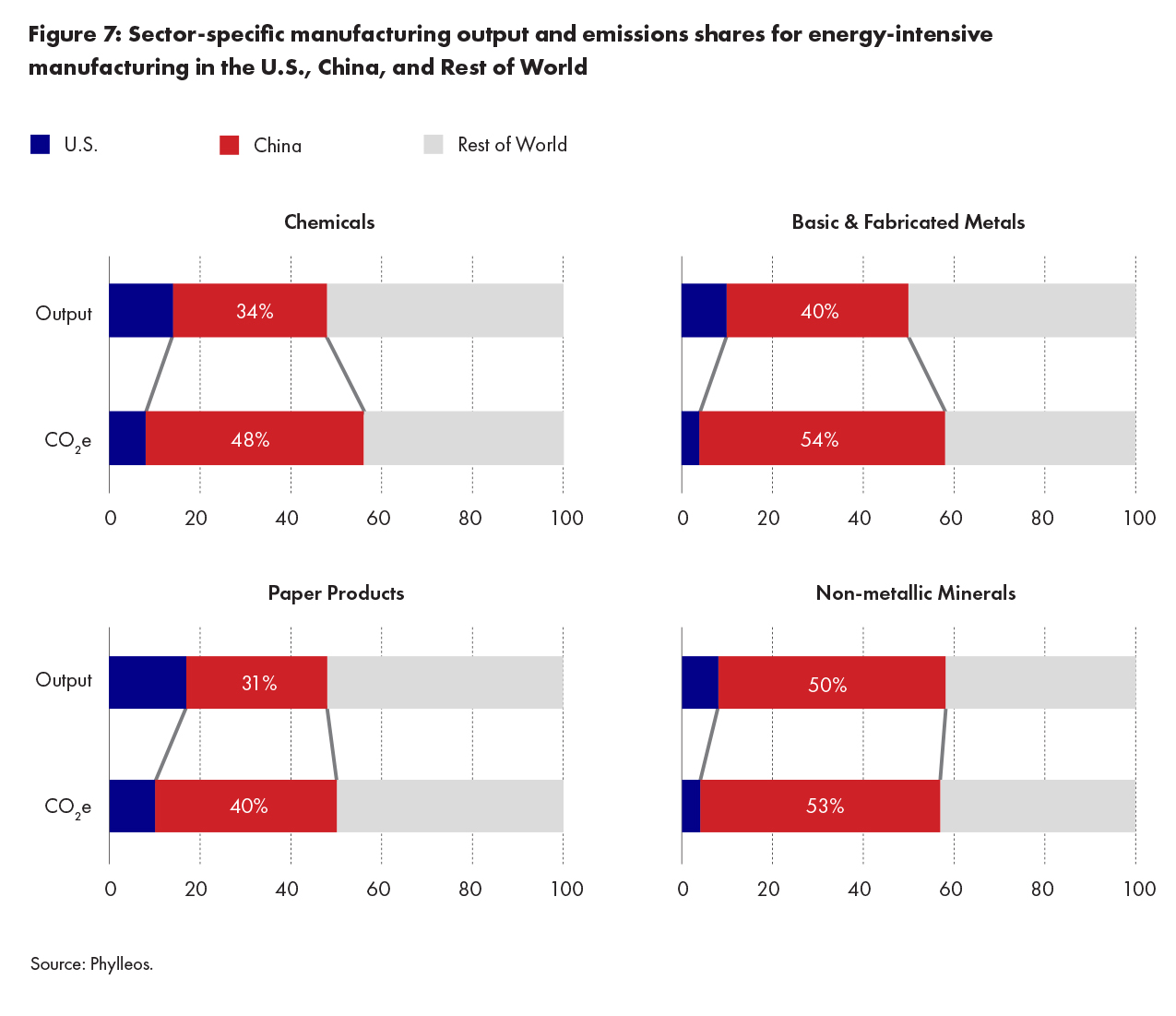

A consequence of this carbon-intensive energy mix is that China is responsible for a disproportionately large share of global emissions. In other words, China’s share of global emissions is even larger than its share of manufacturing output.

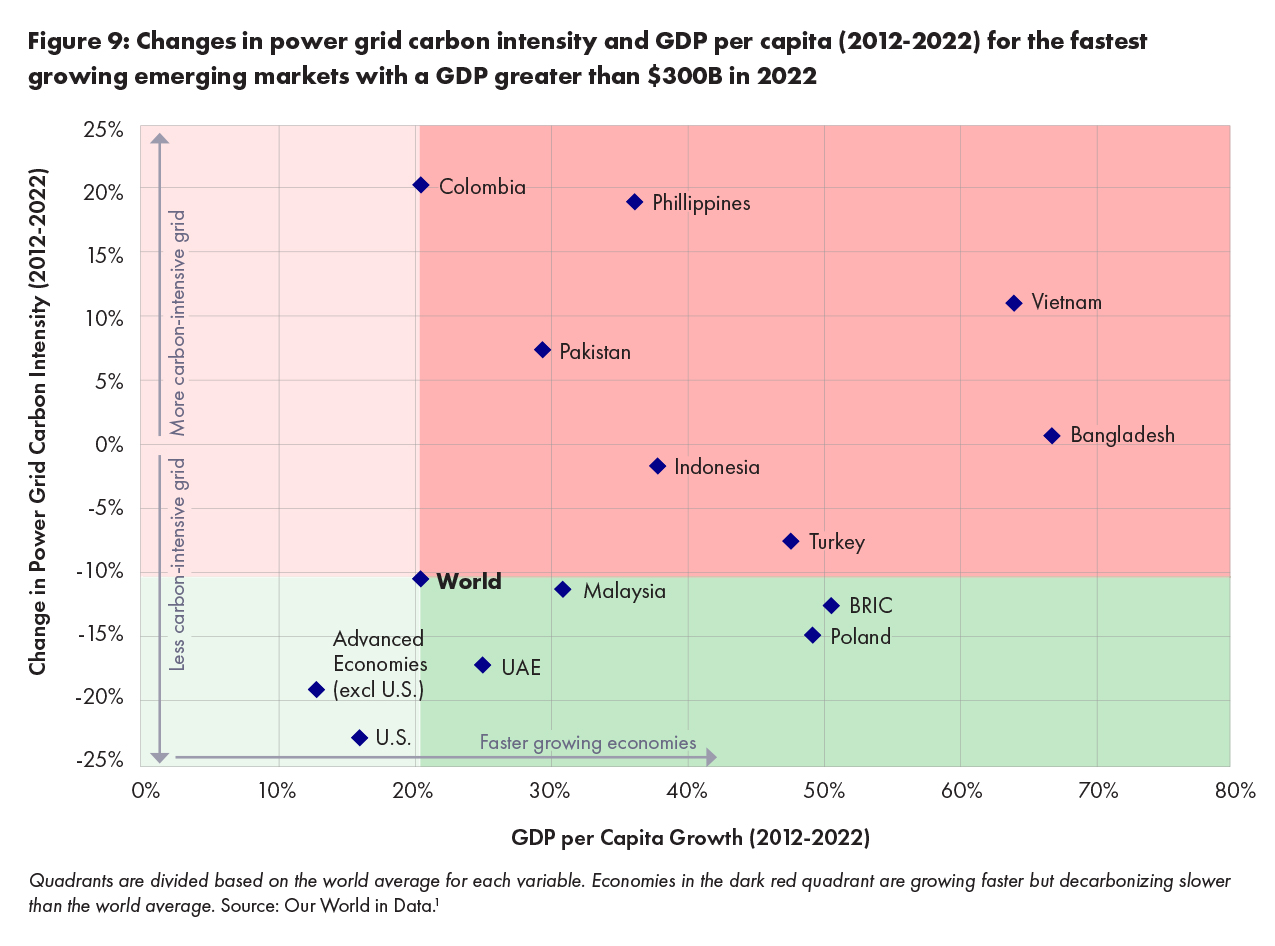

Decarbonization in Emerging & Developing Economies

Emerging and developing economies are growing the fastest but decarbonizing the slowest. Emerging market emissions are set to double by midcentury due to massive load growth and increased economic activity. The world’s poorest economies should not be expected to prioritize climate efforts at the expense of building a richer, more secure future. Still, the increase in coal-fired industrial capacity presents some long-term challenges. It also presents an opportunity for American firms producing the goods and services needed to industrial and decarbonize these rapidly growing markets.

Continued exploration of the differences in carbon intensity and the underlying trends is vital. American firms are poised to lead in a new era of trade that values higher environmental performance. This advantage will persist in the years and decades ahead, so long as U.S. manufacturers maintain their commitment to innovation and U.S. policymaking ensures global trading rules appropriately reward cleaner firms.

You can learn more about carbon efficiency in the publications below.